Introduction to No Credit score Verify Automotive Loans

No credit score test automobile loans signify a monetary resolution tailor-made notably for people grappling with unfavorable credit ratings histories. Not like conventional automobile loans that usually scrutinize the borrower’s credit score rating as a major qualifying issue, no credit score test automobile loans don’t depend on credit score historical past assessments. This attribute makes them an interesting possibility for many who might have confronted monetary difficulties up to now and are looking for to enhance their circumstances via car possession.

The essence of no credit score test automobile loans lies of their accessibility, as they give attention to different standards such because the earnings stage of the borrower, the worth of the car, and the power to make common funds. The absence of credit score checks helps to streamline the borrowing course of, permitting people with poor credit score scores to bypass the customarily stringent necessities set by standard lenders. This method not solely opens up avenues for automobile possession but in addition assists debtors in rebuilding their credit score by making well timed funds on the mortgage.

Lately, the recognition of no credit score test automobile loans in Canada has surged as extra lenders acknowledge the demand for versatile financing choices. Many Canadians are in want of dependable transportation for work, household commitments, or private mobility, making these loans notably related. By catering to a demographic that has been historically marginalized by commonplace lending practices, these loans signify a pivotal growth within the auto financing panorama, emphasizing inclusivity and alternative.

As such, no credit score test automobile loans present not simply a right away monetary resolution but in addition a gateway for debtors to regain their monetary footing whereas guaranteeing they’ve entry to the day-to-day sources needed for residing a useful life. Understanding the mechanisms and implications of those loans is crucial for potential debtors contemplating this path.

Understanding Dangerous Credit score and Its Impression on Automotive Financing

Adverse credit is usually outlined by a low credit score rating, usually under 620, which signifies the next threat for lenders. Elements contributing to a poor credit standing embody missed funds, defaults on loans, excessive credit score utilization, and accounts in collections. These parts mirror a borrower’s capacity to handle debt and repay loans responsibly. When people have a historical past of economic mismanagement, it will possibly result in important challenges, notably when looking for automobile financing. Lenders generally consider the creditworthiness of debtors utilizing credit score scores, and people with low scores might face stringent situations or outright denial of their utility.

People experiencing unfavorable credit ratings usually encounter boundaries in securing a car mortgage, as conventional lenders incessantly categorize them as high-risk debtors. Such lenders might impose increased rates of interest, require bigger down funds, and even prohibit the mortgage phrases out there. This predilection for warning can considerably hinder the power of these with unfavorable credit ratings to obtain dependable transportation, which is crucial for attending work, assembly private obligations, and facilitating every day actions.

Furthermore, lenders use credit score scores as a major metric for threat evaluation, resulting in an automated bias in opposition to potential debtors with decrease scores. This creates a cycle the place people needing loans probably the most, maybe on account of an absence of dependable transportation, discover themselves additional marginalized. Moreover, the notion of unfavorable credit ratings extends past simply the numbers; it usually carries stigmas that may have an effect on debtors’ confidence and monetary alternatives. Consequently, it’s essential for these with poor credit score scores to grasp their present monetary standing and discover various financing choices that cater to their particular circumstances, comparable to no credit score test automobile loans.

How No Credit score Verify Automotive Loans Work

No credit score test automobile loans are particularly designed for people who might have difficult credit score histories or decrease credit score scores, thus permitting them to safe financing for car purchases with out the normal boundaries related to credit score evaluations. The mechanics of those loans differ considerably from standard auto financing choices.

The applying course of for no credit score test automobile loans usually begins with the borrower submitting a web based or in-person utility to a lender. Not like conventional lenders who closely depend on credit score scores, these lenders give attention to various standards to evaluate a borrower’s capacity to repay the mortgage. Key elements usually embody the applicant’s earnings, employment standing, and the scale of the down cost being provided. This method opens up alternatives for people who might in any other case be denied financing on account of their credit score historical past.

It’s essential for debtors to exhibit constant earnings as this serves as a basic indicator of their capability to fulfill month-to-month cost obligations. Lenders might request proof of employment or current pay stubs to confirm earnings stability. Moreover, potential debtors who can present a big down cost might discover themselves in a extra favorable place, as a bigger deposit can cut back the general mortgage quantity required and exhibit a stage of dedication to the acquisition.

Varied forms of lenders, together with credit score unions, on-line lenders, and sure dealerships, present no credit score test automobile loans. A few of these lenders might impose increased rates of interest to offset the dangers related to lending to people with poor credit score histories. Consequently, it’s essential for debtors to fastidiously evaluation the phrases and situations of the mortgage settlement earlier than continuing, guaranteeing they perceive their monetary obligations over the period of the mortgage.

Execs and Cons of No Credit score Verify Automotive Loans

No credit score test automobile loans present a pathway for people with poor credit score histories to safe auto financing. One of many major benefits of those loans is the simpler entry to financing. Conventional lenders usually require an intensive credit score analysis, which may disqualify many debtors. In distinction, no credit score test loans can expedite the applying course of, making it less complicated for these in want of fast transportation. Approval instances for these loans are usually faster, permitting debtors to acquire the required funds for a car promptly.

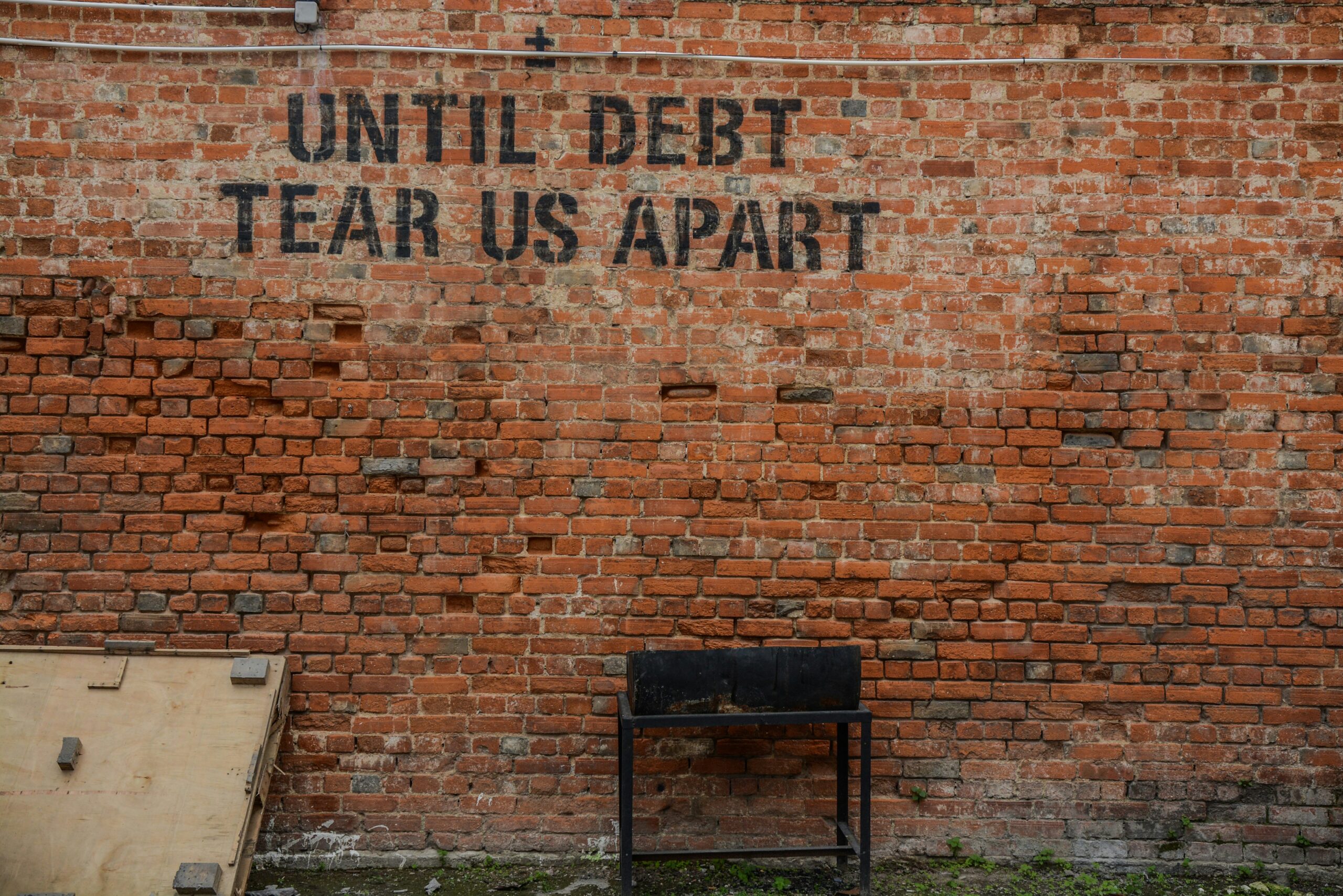

Regardless of these advantages, it’s essential to acknowledge the potential drawbacks related to no credit score test automobile loans. One important concern is the probability of upper rates of interest. Lenders who don’t assess credit score are sometimes taking up better dangers and should compensate by charging elevated charges, which may result in costly long-term debt for debtors. Moreover, the absence of a credit score test might appeal to unscrupulous lenders who have interaction in predatory lending practices. These lenders would possibly impose hidden charges, apply strain techniques, or create phrases which can be unfavorable to debtors, resulting in monetary misery.

Moreover, whereas no credit score test automobile loans can handle fast monetary wants, they could not contribute to enhancing the borrower’s credit score rating. Accountable reimbursement of conventional loans usually aids in rebuilding creditworthiness, whereas this feature might not have the identical impact. Finally, it’s important for potential debtors to weigh the advantages and the drawbacks totally earlier than getting into right into a no credit score test automobile mortgage settlement. Evaluating numerous lending choices and understanding the phrases is important to creating an knowledgeable choice that aligns with one’s monetary state of affairs.

The place to Discover No Credit score Verify Automotive Loans in Canada

Discovering no credit score test automobile loans in Canada generally is a daunting course of, particularly for people with unfavorable credit ratings. Nonetheless, a number of avenues exist the place one can efficiently safe financing regardless of their credit score historical past. One outstanding possibility is using on-line platforms devoted to providing loans. These web sites concentrate on connecting debtors with lenders keen to supply no credit score test loans. By utilizing these platforms, debtors can simply evaluate charges and phrases, which may help in making an knowledgeable choice.

One other avenue to think about is dealership financing. Many automobile dealerships have in-house financing choices that don’t require a credit score test. These dealerships usually work with quite a lot of lenders, together with these specializing in loans for people with poor credit score. It’s advisable to go to a number of dealerships to discover totally different financing presents. Whereas dealership financing could appear handy, it is vital for debtors to totally learn the phrases and situations, as some might characteristic increased rates of interest in comparison with different choices.

Credit score unions additionally supply a possible resolution for locating no credit score test automobile loans. Not like conventional banks, credit score unions are member-owned and sometimes give attention to serving to their members enhance their monetary conditions. Many credit score unions present versatile mortgage choices and could also be extra keen to approve loans for these with less-than-perfect credit score histories. To entry such loans, it’s advisable for potential debtors to develop into members of a credit score union, which usually requires residing in a selected space or assembly different membership standards.

When exploring these avenues, it’s essential to establish respected lenders and keep away from potential scams. Researching on-line critiques, checking with the Higher Enterprise Bureau, and guaranteeing the lender is licensed to function in Canada are important steps within the vetting course of. By taking these precautions, people can improve their possibilities of securing no credit score test automobile loans from reliable sources.

Getting ready to Apply for a No Credit score Verify Automotive Mortgage

Making use of for a no credit score test automobile mortgage can appear daunting, notably for people with unfavorable credit ratings in Canada. Nonetheless, with correct preparation, one can navigate the method extra successfully. Step one is to bolster your monetary profile. This consists of reviewing your earnings, bills, and any present money owed. By demonstrating a steady supply of earnings and a manageable debt-to-income ratio, you improve your attractiveness to lenders, even in a no credit score test state of affairs.

Subsequent, it’s essential to assemble the required documentation. Lenders usually require proof of earnings, employment verification, and identification. Having your current pay stubs, tax returns, and different monetary paperwork organized can expedite the applying course of. Moreover, be ready to supply particulars about your residency standing, comparable to utility payments or lease agreements, as these assist set up your creditworthiness in lieu of a credit score test.

Understanding mortgage presents is one other important side. Not all loans are created equal; phrases, rates of interest, and reimbursement situations can range considerably. It’s important to evaluation the annual share charges (APR) and any extra charges related to the mortgage. Use a web based calculator to match the whole price of various lenders, as this may present readability on what to anticipate in month-to-month funds.

Furthermore, contemplating a co-signer might enhance your possibilities of securing extra favorable phrases. In case you have a trusted particular person with a greater credit score historical past, having them co-sign can mitigate the dangers for lenders. Finally, by enhancing your monetary profile, gathering the best documentation, and comprehensively understanding the mortgage presents, you place your self to safe a no credit score test automobile mortgage that aligns along with your monetary state of affairs.

Options to No Credit score Verify Automotive Loans

People with unfavorable credit ratings usually discover securing a automobile mortgage to be a difficult endeavor. Nonetheless, there are a number of options to no credit score test automobile loans which will present viable choices for financing a car. One of the crucial frequent options is a secured mortgage. On this state of affairs, the borrower presents collateral, usually the car itself or one other invaluable asset, which reduces the lender’s threat. As a result of the mortgage is backed by collateral, lenders could also be extra keen to miss poor credit score histories, probably leading to extra favorable phrases and decrease rates of interest.

One other resolution for people with unfavorable credit ratings is looking for a co-signer. A co-signer with higher credit score can considerably improve the possibilities of mortgage approval. This particular person agrees to tackle the duty of the mortgage, offering reassurance to the lender. Having a co-signer not solely boosts the probability of acquiring financing however also can result in higher rates of interest, as lenders usually take into account the creditworthiness of each the first borrower and the co-signer.

Moreover, some dealerships supply particular financing packages particularly designed for people with poor credit score histories. These packages might give attention to serving to people regain monetary stability by offering automobile loans tailor-made to their wants. Elements comparable to earnings, employment historical past, and down cost also can maintain important weight in figuring out eligibility for these packages. Subsequently, potential debtors ought to analysis numerous dealerships to search out those who supply financing options that cater to their particular circumstances.

An alternate price contemplating is credit score unions, which frequently present loans with extra versatile necessities than conventional banks. Credit score unions usually give attention to their members’ wants and could also be extra keen to work with people who’ve unfavorable credit ratings. By exploring these choices, debtors can discover options to no credit score test automobile loans which will lead them towards profitable car financing.

Ideas for Managing Your Automotive Mortgage Responsibly

Managing a no credit score test automobile mortgage is crucial, particularly for people with unfavorable credit ratings. One of many foremost methods is to ascertain a finances that encompasses your month-to-month mortgage funds, insurance coverage, gas prices, and upkeep bills. By making a exact monetary plan, it is possible for you to to trace your spending, guaranteeing you allocate sufficient funds every month to cowl the automobile mortgage with out straining your different monetary obligations.

Well timed funds are paramount in terms of sustaining a no credit score test automobile mortgage. Organising automated cost deductions out of your checking account is an efficient solution to keep away from lacking due dates. Moreover, take into account marking your calendar or setting reminders in your cellphone a couple of days earlier than funds are due, offering you with further time to organize in case of sudden bills. Late funds can result in penalties and additional injury to your credit score rating, making it important to ascertain a dependable system for cost administration.

Understanding the phrases of your no credit score test automobile mortgage is one other important side of accountable administration. Fastidiously learn all documentation associated to your mortgage settlement, together with the rate of interest, reimbursement schedule, and any potential charges. Familiarizing your self with these phrases will stop surprises and make it easier to make knowledgeable choices. Should you discover the phrases complicated, don’t hesitate to achieve out to your lender for clarification. Information is energy, and being knowledgeable about your mortgage permits you to navigate your financing choices with confidence and effectivity.

Lastly, talk overtly along with your lender. Should you’re dealing with monetary difficulties, contact them as quickly as potential. Many lenders are keen to debate various cost preparations or supply non permanent aid via deferment choices. By taking the initiative to handle your no credit score test automobile mortgage responsibly, you possibly can bolster your monetary stability and work in the direction of enhancing your credit score in the long run.

Conclusion: Making the Proper Selection for Your Monetary Future

Within the quest for car financing, people with poor credit score histories more and more discover no credit score test automobile loans as a viable possibility. All through this information, we’ve examined the intricacies of such monetary merchandise, emphasizing their potential benefits and inherent dangers. It’s important to acknowledge that whereas these loans can present fast entry to a car, they usually include increased rates of interest and fewer favorable phrases in comparison with conventional financing choices.

One of many pivotal discussions surrounding no credit score test automobile loans has centered on the significance of conducting meticulous analysis prior to creating any commitments. Totally different lenders have various insurance policies, charges, and reimbursement constructions, which necessitates an intensive examination of the choices out there. Moreover, it’s crucial to think about the general price of borrowing, together with how excessive rates of interest and charges might have an effect on long-term monetary well being.

As potential debtors navigate their selections, they have to ask crucial questions relating to their monetary state of affairs and what it entails to tackle such debt. Evaluating earnings stability, different monetary obligations, and long-term budgets will help in making knowledgeable choices. Furthermore, potential debtors are inspired to hunt various financing options, comparable to conventional financial institution loans or financing via the automobile dealership, which can present extra manageable phrases regardless of a not quite perfect credit score historical past.

Finally, making the best selection within the realm of no credit score test automobile loans includes cautious consideration and a complete understanding of 1’s monetary panorama. By weighing choices and aligning financing choices with long-term targets, people can shield themselves from extreme debt and navigate their path towards a more healthy monetary future. Whether or not choosing no credit score test lending or various routes, the important thing lies in guaranteeing each step taken aligns with sustainable monetary practices.